BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

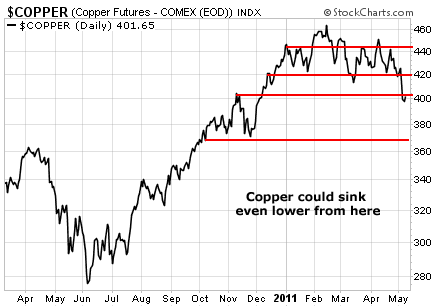

| -- Expecting a week of BEAR this coming week. All indexes are showing weakness. -- FOMC minutes this coming week. Many data in the pipeline too. Expecting some volatility. -- Commodity sell off is expected to continue looking at the GLD and SLV weekly charts. | -- FAZ basically telling us that financial is in really bad shape now. This can bring the entire market down again. -- VXX looks like bottom. -- USO, UNG, GLD and SLV's bad drop may mean something big coming. -- Copper chart is giving warning as a leading indicator. -- Most sectors are showing weakness. |

Next Week Economic Data:

Input:

- Expect some volatility next week.

- FOMC minutes on Wednesday.

- Jobless claim and housing starts all in next week.

VXX chart:

Input:

- VXX looks like bottom. This is very dangerous for stock market.

- All other indicators like MACD, RSI and TMF are pointing north.

SPY chart:

Input:

- Intraday chart shows weakness. MACD and RSI continue to submerge under the medium line.

- Daily chart shows that it is now sitting on a meeting point of 2 trend lines. However, the close is now below 20MA line.

- For the entire week it has 2 times of bearish Harami formation. All other indicators like MACD, RSI and TMF are pointing downwards.

DJIA chart:

Input:

- Similar to SPY, both intraday and daily charts of DJIA are showing weakness. 2 bearish Harami formation in 1 week. All indicators are pointing downward.

NASDAQ chart:

Input:

- Similar to both DJIA and SPY.

UUP chart:

Input:

- UUP is much stronger than I expected. This is bad for stock market.

- Next resistance line is at $22.00.

Sector Analysis:

Input:

- Most sectors are showing weakness. Many are hiding in the utility and health care sectors. Is this the way market behave before big drop?

GLD, SLV, Petrol, Copper and Natural Gas charts:

Input:

- GLD intraday is showing weakness.

- Daily chart shows that resistance is 20MA line. In fact, the 20MA line is a good shorting point.

- SLV intraday looks like SLV started to gain more momentum before closing on Friday. It closed above its intraday 20MA line.

- SLV Daily chart shows that it rebound from its 20MA line and its strong support line.

- SLV weekly chart shows that more drop is yet to come but right now 20MA weekly line is its strong support. If broken it is going to be really interesting.

- Just like SLV, USO had bad drop for a week. It punched through daily 20MA, 50MA and 100MA lines. 200MA line is the strong support.

- USO is coming to its weekly $36.00 trend line support.

- If one likes to trade the yo-yo pattern, UNG will be a good one to be in.

- Weekly chart of UNG shows that it is trying very hard to established a bottom. However, it had just dropped down through the 20MA line. With the bad drop of USO, UNG will be hard to find a bottom yet.

- Copper is always a leading indicator for the market. Its chart is giving warning to the stock market.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Intraday shows that it is still weak.

- Daily chart shows that it is in quite a bad shape. It has broken down from all MA lines (20MA, 50MA, 100MA and 200MA).

- Weekly chart shows that it is coming to 50MA line.

Baltic Dry Index chart:

Input:

- Nope! Not much hope in the Baltic reading yet.

![clip_image001[1] clip_image001[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjC2Ygjy0V0nOIHUb6DtfZD0pCBL1pSmRmXpFGT_HNdZgJ9Otp9zWLDRY-CEyLRwQ6U1cANVsjYo621m8qV314pjZu9llaC3Yba4DpdUP3kD9540BJJqpu9TPw7uJXPISGwSMpe7VnOD7w//?imgmax=800)

No comments:

Post a Comment