BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- It has been a week of correction for all three indexes, however, their uptrend are still intact. They are now testing the 20MA lines. -- GLD and SLV are correcting, especially SLV. Does this mean Bear market, not really. They have gone up way too high and too fast. -- Market might try to decide whether to change course or not. Watch carefully. | -- UUP has rebound harder than I expected even though it has not taken out its downtrend path. -- Will Osama's people do some stupid things? -- Certain sectors (XLF, XLB and XLE) are showing weakness. -- Friday's indexes gap up and then slowly gave in. |

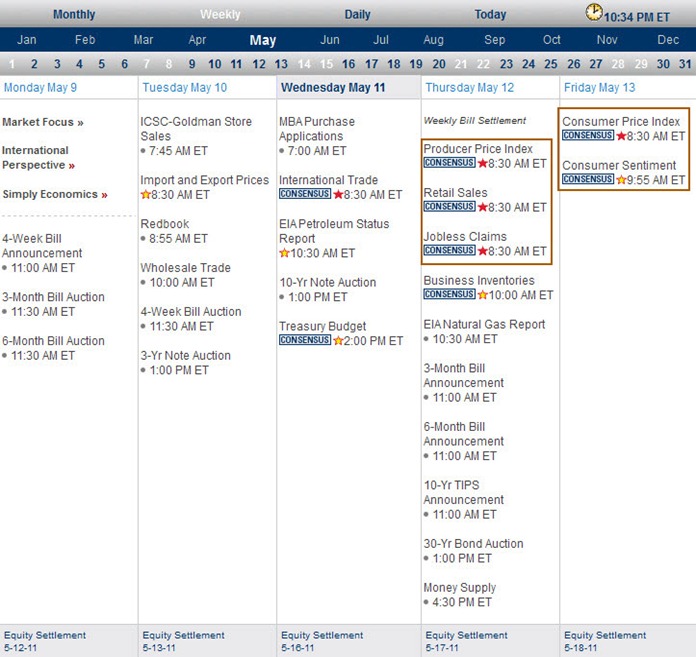

Next Week Economic Data:

Input:

- Watch out for Thursday's and Friday's data. It maybe too much for the market to take it.

VXX chart:

Input:

- VXX downtrend still intact, but it is challenging the downtrend.

SPY chart:

Input:

- Friday market sudden rally gap up and then slowly come almost all the way down. It hurts trader like me. I was kicked out from my FAZ and my short in A.

- Intraday was capped by 50MA line and then it came down lower than 20MA line.

- The market might try to change direction, but now seems like we are not sure bull or bear will win.

- I should have know better to expect a strong rebound.

DJIA chart:

Input:

- Same as SPY.

NASDAQ chart:

Input:

- Same as SPY.

- SPY, DJIA and NASDAQ are all rebound at 20MA line. They are testing the 20MA line and they are showing some kind of weakness on Friday's gap up and then giving back.

- No matter what, the uptrend is still not broken yet. We have to assume that Bull is still in charge here.

UUP chart:

Input:

- Did not expect UUP to rebound that hard. Watch out how it react at the 50MA line. That will decide where the indexes and GLD will be heading to.

- It has good volume in this rebound.

Sector Analysis:

Input:

- Pay closer attention to XLF, XLE and XLB. These 3 sectors are a bit weak compared to the rest.

- Sector analysis shows that Bull is still in charge here.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- GLD rebound with UUP also rebound harder. This is not normal, one has to give in I think. So pay close attention to the reaction of these two.

- SLV rebound is expected both on daily and weekly charts. However, watch closely, the selling force is still strong. Many might take this rebound as a gate way to get out.

- Even though petroleum USO has a big drop, but overall uptrend still in good shape. Take this as a correction first.

- UNG looks like toxic gas but if you look carefully, the uptrend still intact.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Lower high seems like forming at the right hand side. Could this be the Head-n-Shoulder formation?

- It is challenging the 20MA line now. If it breaks thru it and also break the uptrend line that is very close to 50MA, then we will have a confirmation of downtrend.

Baltic Dry Index chart:

Input:

- The uptrend for Baltic may start soon.

- A few shipment counter like FREE and EGLE are plotting very interesting charts.

- If the market is maintaining its uptrend then these shipment counters are good candidates to go long.

No comments:

Post a Comment